Divestiture Framework – Data Perspective

Introduction

The selling of assets, divisions, or subsidiaries to another corporation or individual(s) is termed divestiture. According to a divestiture survey conducted by Deloitte, “the top reason for divesting a business unit or segment is that it is not considered core to the company’s business strategy” and “the need to get rid of non-core assets or financing needs as their top reason for divesting an asset”. In some cases, divestiture is done to de-risk the parent company from a high-potential but risky business line or product line. Economic turnaround and a wall of capital also drive the demand for divestitures.

Divestitures have some unique characteristics that distinguish them from other M&A transactions and spin-offs. For example, the need to separate (aka disentangle) business and technology assets of the unit being sold from that of the seller before the sale is executed. Performing the disentanglement under tighter time constraints, i.e. before the close of the transaction, unlike in the case of an acquisition scenario adds to the complexity.

The critical aspect of the entire process is data disposition. Though similar technologies could have been deployed on the buyer and seller side, the handover can end up painful if a formal process is not adopted right from the due-diligence phase. This is because, in the case of divestiture, the process is not as simple as a ‘lift-shift and operate’ process. There is a hand full of frameworks available in the market detailing the overall process in a divestiture scenario nevertheless the core component which is “data” is touched upon at the surface level and not expanded enough to throw light on the true complexities involved.

What does the trend indicate?

Divestitures and carve-outs are very common in Life Science, Retail and Manufacturing.

If we observe the economic movements and divestiture trend over the past decade, it is clear that the economic conditions have a direct correlation and significant impact on divestiture. So organizations have to proactively start assessing their assets at least annually to understand which assets are potential candidates for divestitures and prepare for the same. This way, when the time is right the organization would be well prepared for the transition services agreement (TSA) phase.

The bottom-line

Overall planning is a critical success factor, however, that process not involving sufficient planning around the “data” component can result in surprises at various points during the course of divestiture and even end up in breaking the deal. End of the day the shareholders and top management will only look at the data to say if the deal was successful or not.

Faster due-diligence, quicker integration, and visible tracking of key metrics/milestones from the start is what one looks for. As per industry experts, having a proactive approach in place has helped sellers to increase the valuation of the deal.

One of the key outputs of this framework is a customized technology and data roadmap. This roadmap will contain recommendations and details around the data and technology complexities that need to be addressed prior to, during, and post the divestiture to ensure a higher success rate for both the selling and buying organization.

The Divestiture Model – Buyer and Seller Perspective

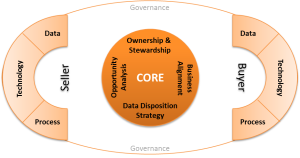

Broadly the Divestiture model has three components: Core, Buyer, and Seller:

- Core component: Handles all activities related to overall due-diligence related to data such as identifying data owners and stewards, data disposition strategy, value creation opportunity (VCO), and enterprise-level data integration with core applications at the buyer and seller end.

- Seller component: Focuses on seller side activities related to data like data inventory, business metadata documentation, data lineage/dependency, business process, data flow/process flow diagrams and level of integration with enterprise apps, business impact on existing processes, and resource movement (technology and people).

- Buyer component: Focuses on buyer-side activities related to data like data mapping, data integration, data quality, technology, capacity planning, and business process alignment.

- Governance: The entire process is governed by a 360-degree data/information governance framework to maintain the privacy, security, regulatory, and integrity aspects of data between the two organizations.

Addressing the “data” component:

Selling Organization

Only a few sellers understand the fact that just getting a deal signed and closed isn’t always the end. From a pre-divestiture perspective, the organization should have a well-defined process for possible carve-outs, a good data inventory with documented business metadata, documented business processes around the non-performing assets, and a clear data lineage and impact document. Armed with this information, the selling organization can get into any kind of TSA comfortably and answer most of the questions the buyer will raise during their due-diligence.

From a post-divestiture perspective, the selling organization needs to assess what technologies and processes need to be tweaked or decoupled to achieve the company’s post-divestiture strategy. A plan to minimize the impact of operational dependencies on existing systems and processes with enterprise applications like ERP when the data stops coming in. If this was not done thoroughly and analyzed well in advance, it can have a crippling effect on the entire organization. A typical mistake committed by the selling organization is, just looking at the cost savings due to alignment/rationalization of infrastructure and missing the intricate coupling the data has at the enterprise level.

Having a divestiture strategy with data as the core of the framework can address a host of issues for the selling organization and speed up the pace of transactions.

Buying Organization

There could be two potential scenarios when it comes to the buying organization. Either the organization already has the product line or business unit and is looking to enhance its position in the market or the organization is extending itself into a new line of business with no past hands-on experience. In the case of the former, the complexities can be primarily attributed to migration and merging of data between the two organizations. Questions like what data to keep/pull, what technology to use, what data requires cleansing, similarities in processes, capacity planning to house the new data, what tweaks will be required to existing reports, the new reports that need to be created, to show the benefit of the buy to shareholders, etc. arise.

The pre-divestiture stage will address most of the questions raised above and based on the parameters a strategy is drawn for data disposition. During the divestiture stage, when the data disposition is actually happening, new reports, scorecards, and dashboards are built to ensure complete visibility across the organization at every stage of the divestiture process.

In the latter case where the organization is extending itself into a new line of business, questions like should a lift and shift strategy be adopted or should just the key data be brought in, or should it be a start from a clean state, etc. arise. There is no one correct answer for this as it depends on the quality of processes, technology adopted and data coming from the selling organization.

Divestiture Data Framework

The Divestiture Data Framework was designed to highlight the importance of the core component which is “data”.

One of the key outputs of this framework is a customized technology and data roadmap. The roadmap will contain recommendations and details around both data and technology complexities that need to be addressed prior to, during, and post the divestiture to ensure a higher success rate for both the selling and buying organization.

Categories: Consulting

Tags: carve-out, data, divestiture, framework, model, spin-off

Comments: No Comments.